So what is the

problem, WSF? Just this, I shouldn’t qualify.

In the many years

spent retailing automobiles I became something of an expert on retail credit.

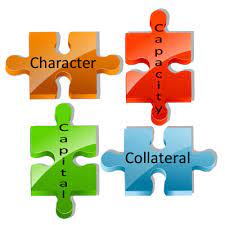

The basis of loan decisions is the four Cs.

Character, as in

your credit history. Things like loans paid off as agreed, bankruptcy,

collections, delinquent child support, unpaid judgments, etc. Next is capacity.

What is your debt load now against the income you have now. Third is capital as

in savings, asserts such as homes, stock market shares, etc. In other words,

are you worth suing? Four is collateral. After your down payment, if any, how

much of the value of the item being financed is the lender carrying.

Another factor is

your credit score which is determined by organizations like Equifax based on

their evaluation of your credit history. The rating is from 0 to 800+.

In my case, none of

my income can be attached. Social security can’t be touched. Unless it is a

capital item like my recent computer purchase, little of what I publicly own is

worth going after should I default on a credit card. My “character” coupled

with a very high FICA score is my only one of the four Cs that justifies such a

high credit line.

There is no rational

reason for Chase to give me such a large credit limit. Should I max out the

card then never pay, they are fucked. They will have next to zero recourse.

Perhaps because I

pay the full balance off each month on all my cards that is their rational. If

so, they are stupid.

So, WSF, what is

your point. Just this. High risk credit seems to be the norm. As someone who

lived through the dismal Carter/Reagan years and the 2008 subprime collapse, I

hate seeing the same mistakes being made over and over. The rich didn’t get to

be rich being stupid (unless they inherited). Why are they acting, on the

surface, stupid? What is the payoff for them?

As always, YMMV.

On a related line of thought.

Along this line, why shouldn’t they play

this game. You, the depositor in their bank is the one on the line. Check this

out.

Can banks take your

money to save themselves?

The Dodd-Frank Act. The law states that a U.S.

bank may take its depositors' funds (i.e. your checking, savings,

CD's, IRA & 401(k) accounts) and use those funds when necessary to keep

itself, the bank, afloat.Mar 18, 2020

Comments don't seem to be posting. Here are two.

3 comments:

LSP

Low profile is best, IMO.

OldNFO

Same Dodd-Frank laid such administrative requirements small town and even regional banks were forced to merge/sellout/quit.

Proverbs 22:7 "The rich rule over the poor, and the borrower is slave to the lender."

WWW

Yes!

Post a Comment